Member-only story

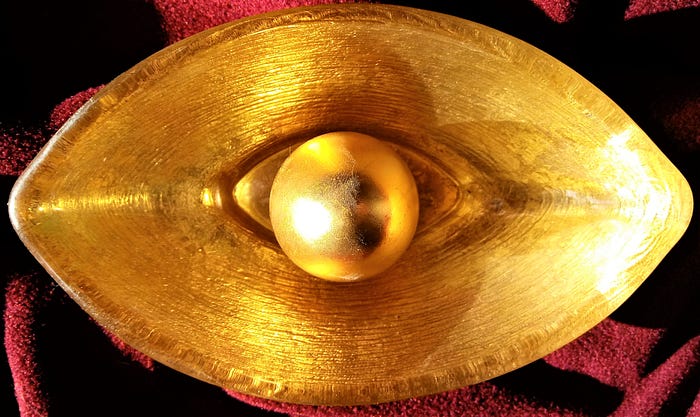

The Gig Worker’s Nest Egg: a Guide for Making it Golden

First, the bona fides: I left my last full-time salaried job in 1990, at the age of 36, with the goal of never having a boss other than myself again. That was 30 years ago. Today I am mostly retired. My home is a paid-off, comfortable condo in an urban-proximate zip code. I live on Social Security, a small pension from an earlier period of employment, and a small stream of monthly income from writing. My retirement savings approaches the mid six figures but I’m not touching any of it yet; I don’t need to.

Most importantly, I never in my whole working life made more than $50,000 in one year, and most years, especially in the last 25, my annual income was closer to half of that. Your results will vary. Hopefully not by much, especially if you start now.

Minimize your taxes, but not your income

Unless you’re blessed with a dependable self-employment income stream or some fat ongoing gigs, your income might swing wildly from year to year — mine certainly has. Your instinct when this happens is to minimize your net income in order to minimize your taxes. Take every legitimate tax break and write-off expense available to you, but keep your eye on the bottom line. It may seem painful to pay taxes now but the higher your taxable income, the greater your contribution to Social Security. The benefit that awaits you at retirement age or later is calculated on the basis of your 35 most profitable working years. You want to make sure that you have that 35 years of significant earnings in order to maximize your benefit.

A retirement dollar saved now is two dollars that you can enjoy later

You’ve read, heard, and seen this advice before and if you’re not acting on it, you are robbing your future self of security. Make every effort to max out your contributions to a regular IRA every year, and start a SEP-IRA if you have self-employment earnings. Fill that up to the max as well, every year that you can afford to. Both of these things will reduce your taxes. Most tax software will quickly calculate for you what your maximum contribution is to any kind of IRA and you have until April 15 of the year following the tax year to stow the money away. Slow and steady invested savings over a period of 40 years or so will yield amazing results.